A Derivative is a financial instrument whose value is derived from an underlying asset or group of assets. They are a contract between two or more parties. The value of this contract depends on changes in the value of the asset that the derivative’s value is derived from. Derivatives enable parties to trade specific financial risks – such as interest rate risk, currency, equity and commodity price risk, and credit risk – to other entities who are more willing, or better suited, to take or manage these risks, typically, but not always, without trading in a primary asset or commodity. The risk embodied in a derivatives contract can be traded either by trading the contract itself, such as with options, or by creating a new contract which embodies risk characteristics that match, in a countervailing manner, those of the existing contract owned.

Derivatives contracts are usually settled by net payments of cash, often before maturity for exchange traded contracts such as commodity futures. Cash settlement is a logical consequence of the use of derivatives to trade risk independently of ownership of an underlying item.

The Participants

The paper identifies three broad categories of participants in the derivatives markets – hedgers, speculators, and arbitrageurs trade in the derivatives market. Hedgers face risk associated with the price of an asset. They use futures or options markets to reduce or eliminate this risk. Speculators wish to bet on future movements in the price of an asset. Futures and options contracts can give them an extra leverage; that is, they can increase both the potential gains and potential losses in a speculative venture. Arbitrageurs are in business to take advantage of a discrepancy between prices in two different markets.

Derivatives have an expiration date. This means that after a certain date they become completely worthless. Hence, they must be utilized within a given time period or else they do not hold any value. Theoretically speaking, derivative contracts can be settled in both cash as well as kind. This means that the person executing the contract has the right to ask for delivery of the underlying commodity or the amount of money which is equivalent to the underlying commodity. However, in reality derivative contracts are usually always settled in cash. Another characteristic of derivatives is that they are characterised by extremely large leverage ratios. Leverage ratios of 25 to 1 and 33 to 1 are common while trading derivatives.

What are Binary Options?

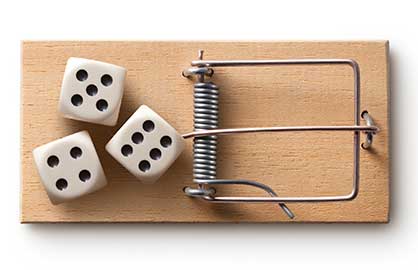

Binary options are a type of derivatives contract. The UK regulators Financial Conduct Authority (FCA) have described binary options as “a form of fixed-odds betting. Typically, a trade involves predicting whether an event will happen or not (for example, will the price of a particular share or asset go up) and the outcome is either yes or no. If the investor is correct, they ‘win’ and should see a return on their investment; if they’re wrong, they lose their full investment.

Binary options can go by many other names. On forex or interest rate markets, they are called digital options. On the American Stock Exchange they are called fixed-return options (FROs) or all-or-nothing options. They are commonly called ‘binary’ because they offer returns in only two outcomes: something (for example, a pre-set amount of $100) or nothing. Binary options allow you to make bets on financial products (including shares and foreign exchange), markets or economic events.

Binary options share all of the same underlying factors as traditional vanilla options. When pricing binary options, the same inputs are used to determine its value. The only way in which they differ is their pay-out structure on expiry. On expiry of a binary option, the pay-out of the option is only one of two outcomes. That is either 0 or 1 (100). This is why it is sometimes termed “binary” or “digital.

Types of Binary Options

The paper highlights the following types of binary options:

- One touch – This type of option pays out an investor’s profit once the price of the underlying asset reaches a predetermined barrier, also known as a “trigger”.

- No-touch – The no-touch option works in the opposite fashion to one-touch options. The investor wages that the underlying asset will not reach a certain price level. Just like the one-touch option, the investor, or broker, select a certain price level above or below the spot (current) price and bet that the price will not reach the determined level within the expiration period.

- Double one-touch – Double one-touch options follow the same logic as one-touch options. However, here we have two triggers, one of each side of the spot price. An option will become “in-the-money” if the price of the underlying asset breaks through one of the triggers, no matter which one.

- Double no-touch – Double no-touch options follow exactly the opposite principle compared to the double-touch options. There are two triggers here as well, but for the option to be “in-the-money” the underlying asset’s price shouldn’t reach either of them during the expiration period.

- Paired options – Paired options are another, more exotic type of binary options. They are offered only by some brokers and are based on the performance of one asset relative to another.

Shariah Perspective

The paper ends with reviewing the Shariah non-compliant issues in binary options. The paper identifies that binary options violate a number of prohibitions in Islamic finance. Binary options are Riba-based trades. An investor can unjustly earn more than the money staked. Riba is not just limited to unjustified increment above the principal amount; Riba extends to any unwarranted and unjustified payments too. The classical jurists term such profiteering and premiums as Ribh maa lam Yudhman (profit for which no risk was borne). Binary options are plagued with a key prohibition in Islamic finance of Maysir and Qimar. Maysir and Qimar refer to betting and wagering. Mufti Muhammad Taqi Uthmani states that Qimar consists of two factors:

- payment is certain from one side, but uncertain from the opposite side; and

- there are only two outcomes of this activity, either the payment made may be lost or may fetch more money.

The paper concludes with a bond statement that binary options do not serve any economic purpose to the traders besides speculative gain. Hence, there is no alternative contract developed by practitioners in the Islamic finance industry. Investors and traders have a variety of Shariah compliant products available in the markets to invest and make profit according to their risk-return-maturity needs and appetites.