Launched in 2014, Tether is a blockchain-enabled platform designed to facilitate the use of fiat currencies in a digital manner. Tether works to disrupt the conventional financial system via a more modern approach to money. Tether has made headway by giving customers the ability to transact with traditional currencies across the blockchain, without the inherent volatility and complexity typically associated with a digital currency. As the first blockchain-enabled platform to facilitate the digital use of traditional currencies (a familiar, stable accounting unit), Tether has democratised cross-border transactions across the blockchain.

USDT Token

Tether tokens exist as digital tokens built on bitcoin (Omni and Liquid Protocol), Ethereum, EOS, Tron, Algorand, SLP and OMG blockchains. These transport protocols consist of open source software that interface with blockchains to allow for the issuance and redemption of cryptocurrency tokens

How does Tether Work?

Tether tokens exist as digital tokens built on bitcoin (Omni and Liquid Protocol), Ethereum, EOS, Tron, Algorand, SLP and OMG blockchains. These transport protocols consist of open source software that interface with blockchains to allow for the issuance and redemption of cryptocurrency tokens, in our case, “Tether tokens.” Tether Platform currencies are 100% backed by Tether’s reserves. Tether tokens are redeemable and exchangeable pursuant to Tether Limited’s terms of service. The conversion rate is 1 Tether USD₮ token (USD₮) equals 1 USD.

The Tether Platform is fully reserved when the sum of all Tether tokens in circulation is less than or equal to the value of our reserves. Through our Transparency page, anyone can view both of these numbers on a daily basis.

The Tether Platform is fully reserved when the sum of all Tether tokens in circulation is less than or equal to the value of our reserves. Through our Transparency page, anyone can view both of these numbers on a daily basis.

Tether tokens are new assets that move across the blockchain just as easily as other digital currencies. Tether currencies are not money, but are digital tokens formatted to work on blockchains. Tether tokens hold their value at 1:1 to the underlying assets.

Tether was originally created to use the Bitcoin network as its transport protocol—specifically, the Omni Layer—to allow transactions of tokenised traditional currency. Since this original version of Tether uses the Bitcoin blockchain it inherits the inherent stability and security of the longest established blockchain network.

“Tether is a blockchain-enabled platform designed to facilitate the

use of fiat currencies in a digital manner.”

Tether on the Ethereum blockchain, as an ERC20 token, is a newer transport layer, which now makes tether available in Ethereum smart contracts or decentralized applications on Ethereum. As a standard ERC20 token it can also be sent to any Ethereum address.

What real-world currencies does Tether support?

Tether initially supports US Dollars (USD), Euros (EUR), and the offshore Chinese yuan (CNH). Represented by ₮, Tether platform currencies are denoted as USD₮, EUR₮, CNH₮.

Who can use Tether?

Tether enables businesses – including exchanges, wallets, payment processors, financial services and ATMs – to easily use fiat currencies on blockchains. Some of the largest businesses in the digital currency ecosystem have integrated tether.

Individuals can also use tether-enabled platforms to transact with Tether tokens.

Controversary

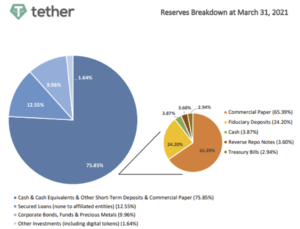

Although Tether initially claimed that each Tether was backed by a US Dollar at a 1:1 ratio, in March 31 2021, Tether released the following:

As you can see, the blue pie chart shows that 75.85 per cent of Tether’s reserves are, according to the company, backed by “Cash & Cash Equivalents & Other Short-Term Deposits & Commercial Paper”. The smaller, orangier pie chart breaks down that 75.85 per cent, and it turns out that the stablecoin that used to say it was 100 per cent backed by cash reserves is in fact . . . 2.9 per cent backed by cash reserves (3.87 per cent of the 75.85 per cent)

Tether claims in the whitepaper the following:

“We could go bankrupt ¬ In this case, the business entity Tether Limited would go bankrupt but client funds would be safe, and subsequently, all tethers will remain redeemable. Tethers may be redeemable/exchangeable for the underlying fiat currency pursuant to Tether Limited’s terms of service or, if the holder prefers, the equivalent spot value in Bitcoin. Once a tether has been issued, it can be transferred, stored, spent, etc just like bitcoins or any other cryptocurrency. Hence, the redeemability of a token is not contractually guaranteed.”

Conclusion

Based on and subject to the foregoing information, and for the purposes of this conclusion, nothing has come to our attention that causes us to believe that Tether is in breach of Sharia* principles and rulings as adopted by the scholars conducting this research.

It should be noted that though the utility of Tether itself is to function as a payment token, there are concerns about the company. There should be caution and review on the developments of Tether and the company itself.

*Attention is drawn to the term ‘Sharia’ and ‘Sharia compliant’ and its interpretation thereof as expressed in the following link https://shariyah.net/glossary/